Have you ever wondered why you hear of so many people snowbirding or buying properties in Florida, Texas or Nevada as they are getting close to retirement? Nice weather of course- but there may be more of a strategy behind it as well.

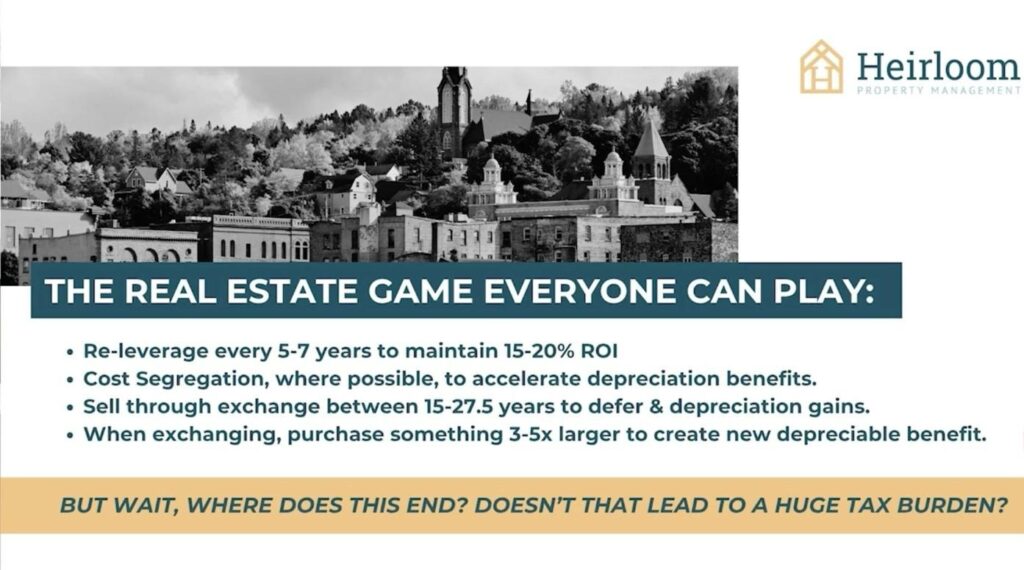

Real Estate Investors who have spent their years in the investment journey doing “ all the right things” for growth like, paying down debt, re-leveraging, doing tax exchanges along the way ect. seem to have a similar question when they hit the end of their investing years. “Now that I am done growing and my wealth is piled up in real estate, how do you handle the tax liability when I sell my portfolio?”

There are a few different options to consider and plan for even in the mid stages of your investing journey.

When selling a property the U.S. government taxes 20% most properties. That’s the same for every state. But in addition to that, you pay state tax which is different by state. As seen in the graph above Minnesota is one of the highest ones, right up there with California. So really what this is showing is it’s 50% higher to sell a property in Minnesota than, any of the red states pictured above.

So if you’re planning out your options for your real estate legacy end game and considering selling everything at some point, it might be worth considering all your options. Exploring doing an exchange into a property or new build in a different state could cut the tax burden down by quite a bit as you go complete the sale of that property at some point. For example, if you own rental properties in Minnesota and you were to exchange all your properties into real estate in Florida and then sell that, you save 9.8% on your life’s net worth.

It’s an interesting thing to consider when looking at the map what your options could be, and I think understanding your own personal endgame will help you with each move you make in your portfolio along the way.

Stay Tuned for End Game- Option B

Interested in doing a 1031 exchange Reach out to our Agents to help guide you down right path for growth.