“Rethinking Cash Flow: What Investors Miss When Evaluating Rentals”

As we near the end of 2025, many real-estate investors are starting to look at their

portfolios breaking down yearly returns, expenses and setting goals for 2026 year

ahead. Many have been holding tight in recent years on purchasing new properties to

expand their portfolios due to various reasons because of things like inventory options,

interest rates, economy ect.

As we start to see new adjustments in the market recently, the investor growth buzz

seems to be starting again. Many are pondering on their next investment opportunities

and the value of a properties cashflow & equity growth as they are adding to their

portfolios. The question comes up is this enough cash flow to make it worth the

investment on this property? A lot of people, myself included, when you get started

investing in real estate, you’re just focused on cash flow. How do I pay the payment?

But really, there’s really a lot more to be made even if your cash flow just breaks even.

Investors look to make money in four ways in real estate. It’s cash flow, its appreciation,

it’s debt pay down, and it’s tax benefit. What’s the most valuable? Depends on your end

goal and the season of your investing journey you’re in.

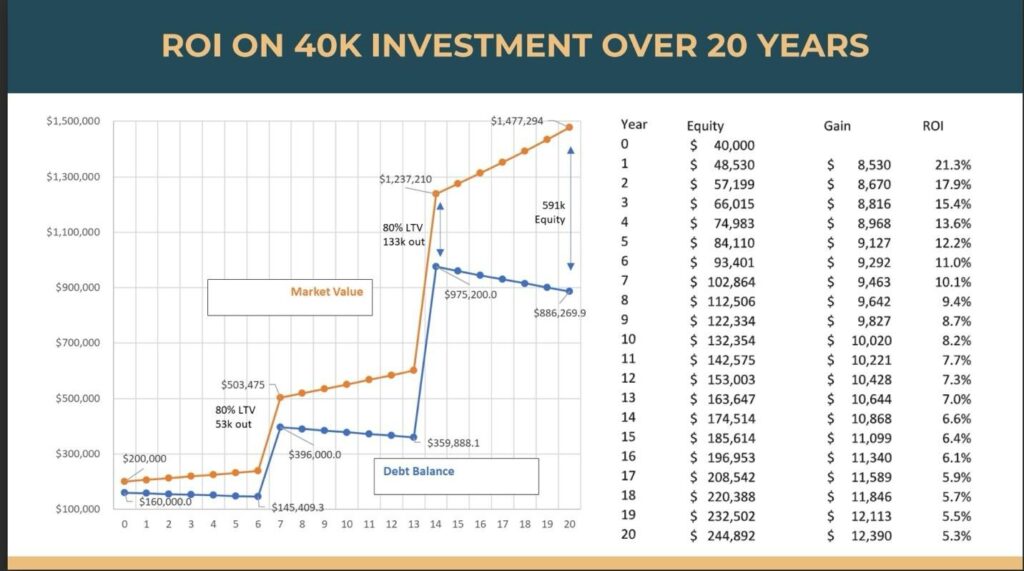

With market expenses changing and high cashflow properties being harder to

accumulate, we took a look at ROI on an investment property without a positive cash

flow assuming your Maintenance / Management / Taxes ect are covered.

For the graphic shared above, we are starting with a $200,000 property, average

property in Duluth is $221,000. Say you buy a $200,000 property and put $40,000

down on it, regardless of which property it is, regardless of what your cash flow is, that

property is going to appreciate and you’re going to pay down principal.

For the $200,000 property, over seven years, on avg it would appreciate about 3% a

year, some years higher some years lower. Meanwhile you’re going to pay down debt

about $15,000 while you’re going to appreciate and have a delta of about $53,000 that’s

removable. You can take it out, and you can grow it. Again, this is an example of buying

a property with 20% down, and this is making no cash flow, just paying down your debt,

and having the appreciation, cash flow would be in addition to this.

Re- Leveraging

Over time, properties start to accumulate value in them. However the ROI on that value,

unfortunately starts to go down. If you’ve had a property for a while, you might start to

consider, oh, maybe I should list it and get all this money out by selling it. But then you’d

be starting back over again. So, depending on the season your in of your real estate

investing journey growing or harvesting the general rule of thumb is that the smart move

is to re-leverage. This is the long game, and this is the bigger game.

This graph shows a re-leverage of at year seven, you take out the $53,000 that it has

gained and buy a new property with it. And now you have two properties, and you have

a higher amount of debt. Then at fourteen years, you buy four properties. And at 21

years, that $40,000 investment, re-leveraged twice, is worth about $600,000. That’s with

no cash flow. And that’s a game everybody can play. That’s just 3% appreciation and

standard debt pay down on a 25-year loan.

So as your planning out your next 2026 growth strategy, is the amount of cash flow the

most important thing to focus on for you?

Working through your next investment property purchase? Use our ROI Calculator to

help break down possible returns and appreciation growth